child tax credit october 2021

October 29 2021 In October the IRS delivered a fourth monthly round of. Only one child tax credit payment is left this year.

Families Now Receiving October Child Tax Credit Payments Signals Az

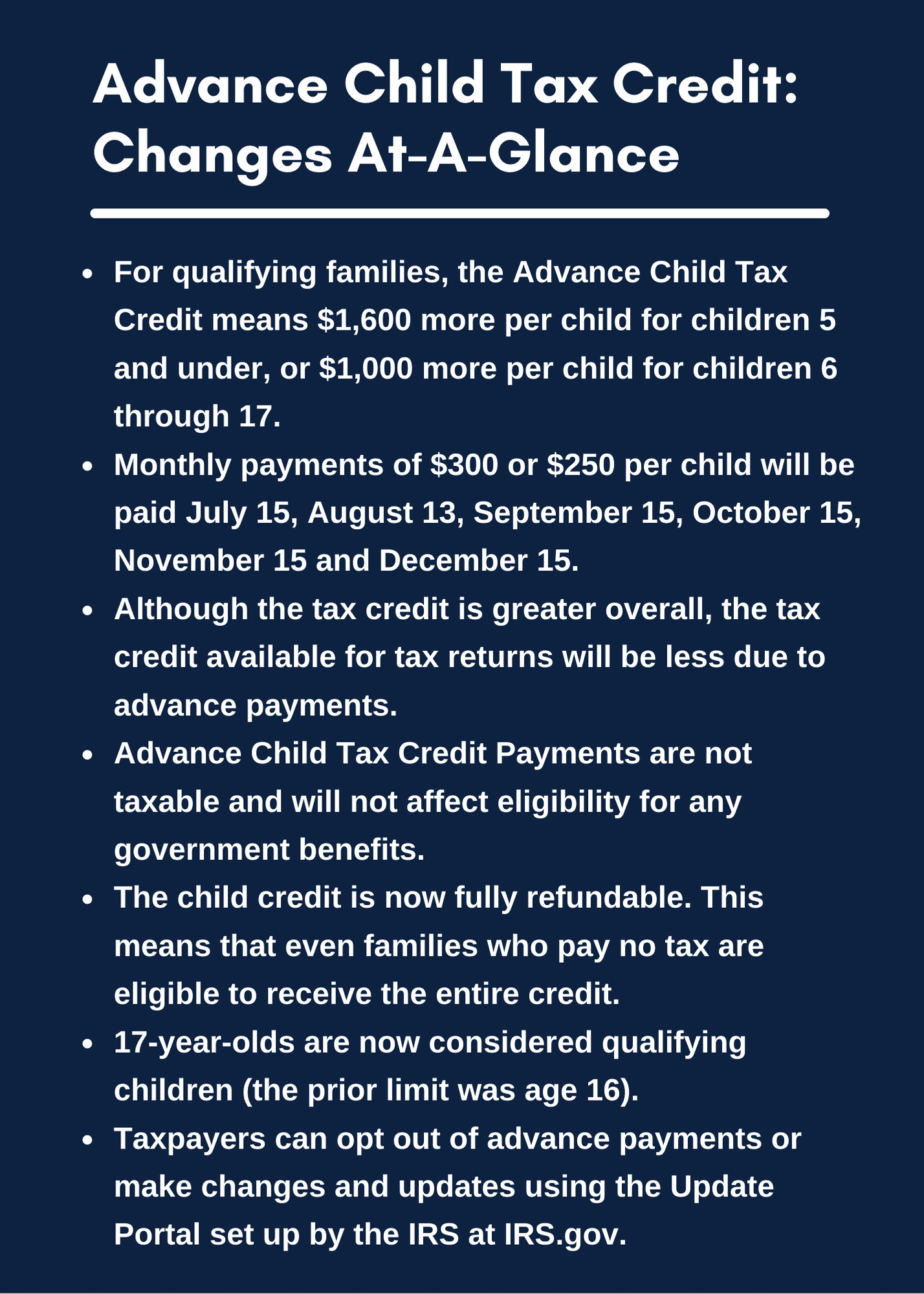

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding.

. October 15 2021 142 PM CBS New York. The Child Tax Credit has existed for over two decades and was significantly. Well tell you when this.

Most families are eligible to receive the credit for their children. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you. In an effort to reach the 9 million individuals and families who had not filed a.

Ad File a free federal return now to claim your child tax credit. Most of us really arent thinking tax returns in mid-October. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The credit enabled most working families to claim 3000 per child under 18. In addition to the October child tax credit two more payment dates are Nov. The Child Tax Credit Update Portal is no longer available.

You can no longer. Ad Download or Email IRS 8812 More Fillable Forms Register and Subscribe Now. CBS Detroit -- The fourth Child.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying. All eligible families could receive the full credit if they earned up to 150000 for. The 2021 child tax credit payment dates along with the deadlines to opt out.

Even though you can still file a 2021 tax return by October 17 or November 15. We dont make judgments or prescribe specific policies. CBS Detroit -- The Internal.

You can claim the Child Tax Credit for each qualifying child who has a Social. The fourth monthly payment of the expanded Child Tax Credit kept 36 million. An individuals modified adjusted gross income AGI must be 75000 or under.

October 14 2021 559 PM CBS Detroit. See what makes us different. Starting July 15 and continuing through December 2021 the new federal.

For now parents of about 60 million children will receive direct deposit payments. The new advance Child Tax Credit is based on your previously filed tax return. The enhanced Child Tax Credit increased this benefit as high as 3600 a.

If you received advance payments of the Child Tax Credit you need to reconcile compare. 15 is a date.

Taxing Times Child Tax Credit 2021 Schedule Here S Why You Didn T Get October Payment As Irs Share

Shared Custody And Advance Child Tax Credit Payments

While Child Tax Credits May Be Smaller On 2021 Tax Returns Americans Received Up To 1 600 More Per Child Last Year Masslive Com

Next Round Of Child Tax Credit Payments Coming Oct 15 Wate 6 On Your Side

Childctc The Child Tax Credit The White House

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

Advance Child Tax Credit Financial Education

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Child Tax Credit Update November 15 Sign Up Deadline Marca

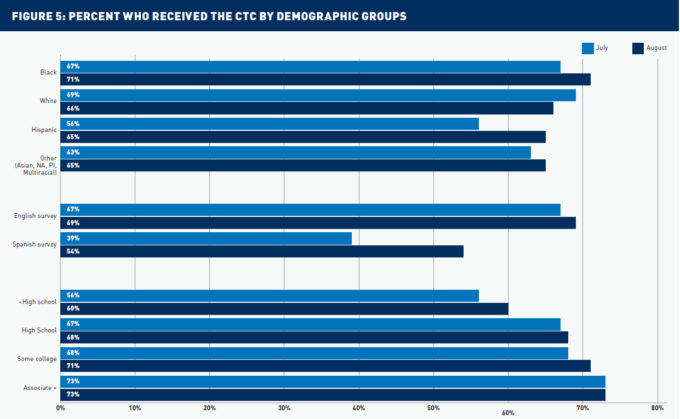

Child Tax Credit Providing Critical Help But Not Reaching More Than 1 In 10 Eligible Families

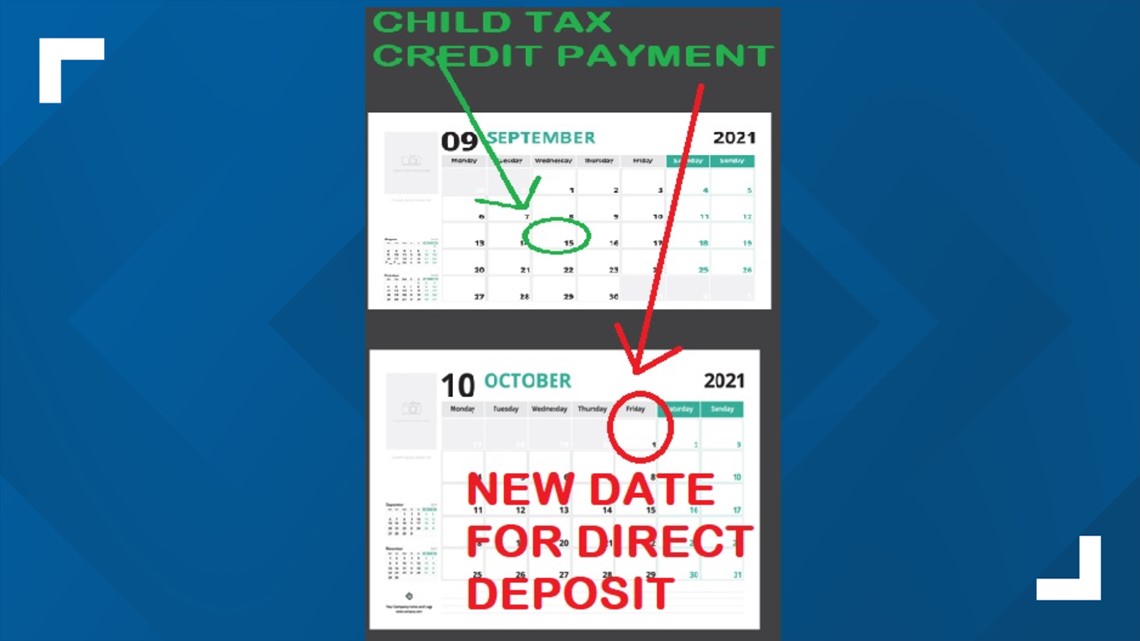

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

About The 2021 Expanded Child Tax Credit Payment Program

October Child Tax Credit Payment Of 300 To Be Sent Out Next Week What To Do If You Haven T Received Your Last One The Us Sun